Shared Ownership

Shared Ownership is a great way for you to get a foot on the property ladder if you can’t afford to buy a home outright on the open market.

It can take away the pressure of having to save for a high deposit or having to make large mortgage repayments.

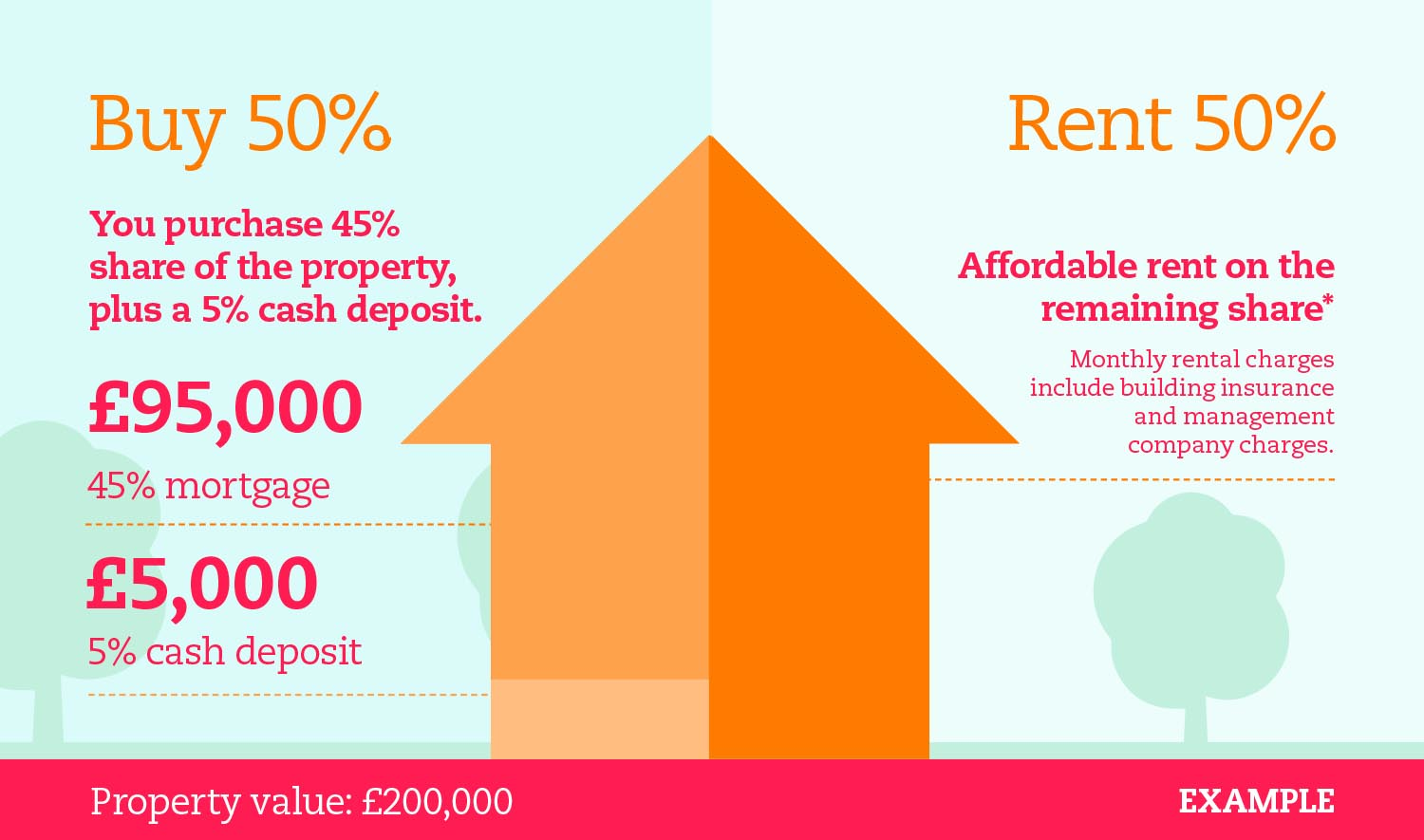

Essentially, it means you’ll be buying a share of your home – up to 75 percent - and paying an affordable rent on the remainder.

For example, if you were to buy 50 percent share of a home worth £200,000, this could be a five percent deposit of £5,000 and a mortgage of £95,000 on the remaining 45 percent, you'll then only pay us an affordable rent on the remaining 50 percent share. The rent that you'll pay us will also include buildings insurance and management company charges, if applicable.

Deposits for Shared Ownership properties could start from as little as five percent. If you get a mortgage on your share of the property, your mortgage is based on the percentage share you own.

This means you get the home that you want, at an affordable price and through a monthly repayment that’s achievable.

You can discover more about Shared Ownership here at Amplius by clicking this button

➡️ Discover Shared Ownership at Amplius

Would you like to contact us and go through your options?

We are here for you throughout your whole Shared Ownership journey. If your circumstances change and you wish to staircase your property or sell your home, we're here to help.

You can find out more about Staircasing here

➡️ Staircasing your home

You can find helpful information about selling your share here

➡️ Selling your share.

“We can buy more of the property over time, while still owning our own home now.”

“I’d 100 percent recommend Shared Ownership with Longhurst Group.” Click on the link to find out more about Paulina's story

Read Sharon and Steven's story on how they bought a 50 percent stake in a Shared Ownership home on our Heron Park development

Abigail and Laura find their dream homes within the same development

“What appealed to me was that I could own something again.” Click on the link to read more about Sarah's story.

Read more from our customers

- Carol says "It's been really easy"

- Increasing his share through staircasing was a "no-brainer" for Steve

- Tim loves his Shared Ownership property

- Shared Ownership made buying a home a “no-brainer”

- Family's dreams of owning their own home made true thanks to Shared Ownership

- It was love at first sight for Kerry

- Jo recommends Shared Ownership "in a heartbeat”