A guide to Shared Ownership

Quick links

Shared Ownership is an affordable, flexible option of purchasing a home and a great way to get a foot on the property ladder if you’re currently unable to buy a property outright on the open market.

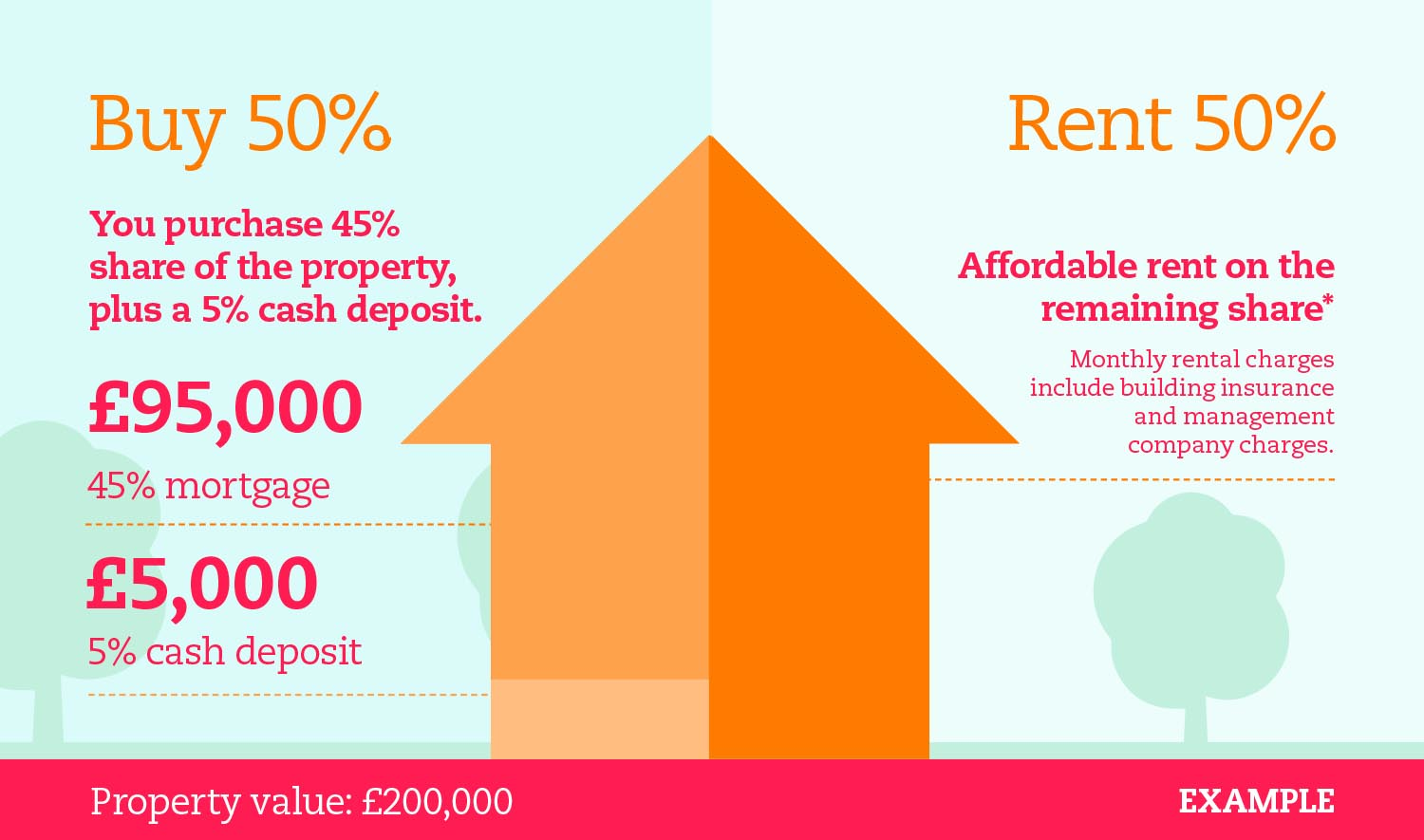

Shared Ownership is a Government-funded Low Cost Home Ownership (LCHO) product. It allows you to purchase a share in a property that’s affordable to you, whilst paying a subsidised rent to us for the unsold equity that remains in our ownership.

Initial shares can be brought in stages and range from 25 percent up to 75 percent depending on the lease., When the time’s right for you, you can staircase and buy additional shares in your home and if your lease allows you can purchase the Freehold interest to own your home outright.

Homes built through the 2021-2026 Homes England funding programme are subject to the new model Shared Ownership lease. If this applies to a property you’re interested in, you’ll have different options for staircasing and will enter into a lease of at least 990 years.

The new model lease also includes changes to who is responsible for ongoing repairs and maintenance, with leaseholders eligible to claim up to £500 each year for the first ten years to put towards general repairs that affect your heating and domestic services such as electric and plumbing.

You can find out more about the new model shared ownership lease here.

- You only need to secure a mortgage (if applicable) for the share in the property you’re buying, making it more affordable.

- You’ll own part of your home, which is more beneficial than renting privately with no return.

- You’ll become a homeowner and gain from the benefit of increases in equity within the share you own (subject to market conditions).

- You can take on the full responsibility of owning your own home.

- Shared Ownership can be a more cost-effective option to buying outright, with the combined mortgage and rent payments normally being less than buying a property outright or privately renting a similar property.

- Subject to the lease, you can normally buy additional shares within your home to eventually own it outright. The more of your home you own, the less rent there is to pay.

Shared Ownership is normally aimed at first-time buyers who are unable to buy a suitable home on the open market due to affordability. However, non first-time buyers may also be considered if they meet the following criteria:

- A previous homeowner who’s looking to get back onto the property ladder following a relationship breakdown and is struggling to afford a property on the open market.

- A previous homeowner who’s had to sell their home for financial reasons and cannot afford to buy a property outright on the open market.

- People who are relocating to a new area due to work or personal circumstances and cannot afford to buy a property on the open market.

- Existing shared owners whose family has grown, or circumstances have changed, but cannot afford a home that meets their needs on the open market.

- All applicants for Shared Ownership must be in a position to pass affordability and financial assessments and be in a position to secure a mortgage for the share. This includes providing evidence that you have enough savings to cover the mortgage deposit (normally 5 to 10 percent) and your moving and legal costs.

- Cash purchasers, ie, buying the share from equity from the sale of a marital home, will also need to provide financial assessment evidence that the property is affordable in the longer term.

You’re unable to buy a Shared Ownership home if you already own a home in the UK or aboard or if you have a joint household income of over £80,000 per annum.

Shared Ownership homes can only be purchased as principle homes and cannot be bought for letting or subletting purposes or for financial gain.

Our dedicated Sales Officers or the appointed estate agents marketing the property will be able to help and guide you through the Shared Ownership application process.

Once you’ve found a property you’d like to apply for, you’ll need to complete a Shared Ownership application form and provide supporting information to allow for your application to be assessed.

Read our Shared Ownership Application factsheet to find out more about the process.

Give us a call and we'll be happy to talk you through your options - 0345 601 9095

- Mortgage payments (if applicable) – you’ll pay a monthly mortgage payment for the share in the property owned by you.

- Shared Ownership rent – You’ll pay a monthly Shared Ownership rent to us for the share in the property retained by us. This’ll be collected by direct debit on the first day of each month. You’ll also pay a Shared Ownership management fee to cover the administration costs incurred by us when collecting your Shared Ownership rent and arranging of buildings insurance.

- Buildings insurance – As the freeholder of the property, we have a liability to ensure that your property is fully insured. We’ll arrange and manage the buildings insurance premium for the property, but you’ll be required to arrange and pay for your own contents insurance and any other relevant insurance policies.

- Service charge – If your home consists of any communal areas, ie, a flat with a communal hallway or a house with communal gardens, pathways and open plan areas, you’ll normally pay a service charge towards the upkeep of the areas.

- The costs of the upkeep of the communal areas will be calculated and split equally between the number of properties on the development and the service charge will be collected on a monthly basis along with your Shared Ownership rent. Information on the areas covered within your service charge will be detailed within your Shared Ownership lease.

- Shared Ownership rents, management fees and service charges are reviewed on an annual basis as detailed within your Shared Ownership lease.

- Please also remember that as a homeowner, you’ll be responsible for Council Tax, utility costs, contents and other relevant insurance policies, telephone, Wi-Fi and TV subscriptions.

You’ll enter into a Shared Ownership lease for the property. You’ll have all of the rights and responsibilities that you’d have if you owned the home outright. The lease will explain your responsibilities as a homeowner, and our responsibilities as the freeholder.

A Shared Owner’s main responsibilities include:

- Paying the monthly mortgage (if applicable), rent and service charge payments.

- Insuring the contents of your home.

- Paying all utility and household bills for your home.

- The upkeep and ongoing maintenance of your home.

- The requirement to obtain permission from us for home improvements and any works undertaken that involves the gas and electrics to the home.

- Adhering to the clauses in your lease regarding nuisance, noise and anti-social behaviour.

- Your responsibilities when selling your home and the costs involved.

Our responsibilities will include:

- Arranging and providing buildings insurance for your home.

- Maintaining the structure of the buildings.

- Managing and maintaining all communal areas of the building (flats) and surrounding shared communal areas.

- Collecting and setting of the annual Shared Ownership rent and service charge payments (if applicable).

We’ll also provide you with a useful booklet ‘Your Lease & Your Rights’ once you apply for a property to allow you plenty of time to read the information and understand the ongoing responsibilities of all parties once the sale completes.

Further help and support can also be found by visiting our Leasehold page for Shared Owners.

As a shared owner, you can buy further shares in your home. This process is known as Staircasing. The greater share you own in your home, the less rent you'll pay to us.

Normally, leases allow for staircasing in multiples of 10 percent shares. Subject to your lease, you may be able to staircase to 100 percent and own your home outright on a freehold basis.

Staircasing allows you to buy more shares in your home at a time that’s affordable to you. It’s a simple process and our experienced Asset Sales Team will help you through the purchase each step of the way.

Our useful ‘Guide to Staircasing’ can be requested by emailing staircasing@amplius.co.uk and can be found on Staircasing page.

When the time comes to move on and sell your Shared Ownership home, there’s a process detailed within your lease that’ll need to be followed. There are also fees that you’ll be liable to pay to us, which include covering our legal costs and paying an administration fee for our time and work involved in processing your sale.

These are in addition to your own legal costs and selling agent’s fees. We’d always recommend you ask your solicitors to go through these with you in detail when you’re buying your home.

When you sell your shares in your home, this is called an ‘Assignment of the Lease’. Our Asset Sales Officers will provide you with a copy of our helpful booklet ‘Selling your Shared Ownership home’ and help you through the process. A copy of the booklet can be requested by email: assignments@amplius.co.uk.

Yes, if you both meet the criteria detailed above and the property will be their only and principle home.

Sometimes there are local authority requirements that priority is given to applicants who live and/or work in the area where the property is located. This’ll be confirmed by the selling agent or our Sales Officer at the time of applying.

All Shared Ownership properties are sold initially as leasehold. If your lease allows and you’re able to staircase up to 100 percent, once this is completed the freehold will be transferred to yourself, subject to any restrictions in your lease and the property type.

Once you move into your home, you become fully responsible for all repairs and maintenance, both internally and externally, unless the works are covered under the terms of the buildings insurance or the property’s defects period (new build homes only).

If your home is a flat, you’ll be responsible for the internal repairs, whilst we'll undertake and manage any communal repairs and maintenance.

You don’t need to seek permission for general decorating and upgrading works, however certain building works will require permission from us, such as extensions, conservatories, and gas and electrical works. You’ll need to ensure that you’ve applied for any relevant buildings and planning permissions before proceeding with any such works and that you’ve consulted with us.

If you’re considering undertaking expensive extension/improvements works, we’d always recommend that you consider Staircasing and buying the property outright first (subject to the terms of the lease). This way, you’ll benefit from the full costs of the improvement works should you decide to sell your home in the future.

When you’re ready to Staircase, our Asset Sales Officers will be able to provide you with further information on how the process works and check your lease for any specific requirements or restrictions.

You can normally staircase at any time under the terms of your lease. An Open Market Valuation Report will be required to determine the current value of your home and the costs of additional shares. The value of your home can go up or down dependant on current market conditions.

The greater the share you own, the less rent you’ll pay. Most leases will allow you to staircase to 100 percent ownership and buy the freehold in your property. This may not always be possible if you live in a Protected Rural Area or if you live in a flat. Should this be the case, we’ll talk you through your options and provide you with further help and advice.

We aim to provide an excellent service to our customers and if we get things wrong we want to put them right and learn from our mistakes.

You can email us at NewHomesSales@amplius.co.uk or call us on 0345 601 9095